Express Money:

Economic Recovery in Debt-Ridden Countries via Fast-Circulating, Slow-Leaking Regional Money

"Give Greece a chance – with a parallel currency that stays" 4 pages, pdf , Christian Gelleri in Evolution, June 2015

In 2011, Christian Gelleri and Thomas Mayer proposed a second currency for Greece. Since then the Greek problems have not been solved and have instead become worse. The country is still enduring severe economic problems and national bankruptcy remains dangerously close. A parallel currency »NEURO« could help to avoid the worst and act as a leverage for the better.

-------------------------------------------------------------------------------------------

Study "Express Money: Avoiding the Eurozone Breakup" Febr. 2012, 12 pages, pdf

Press Release and Discussion:

5.7.2012 - 'People Money - the Promise of Regional Currencies' tells the stories of 14 leading local currency systems from around the world. It is a refreshing dose of positive good news and sanity in a time that is dominated by news of financial crisis and breakdown. The alternatives are real and are happening now.

4.6.2012 - Four Scenarios for Greece - Most promising among them: a euro-backed complementary currency incorporating a spending incentive.

3.6.2012 - Greece Still in Need of Grease from Robert Mittelstaedt

22.2.2012 - Press Release - Express Money: Avoiding the Euro Breakup

25.5.2012 - A parallel currency for Greece: Part I

Abstract Express Money:

The euro crisis can be overcome. The solution is called Express Money.

Its advantages are as follows:

- Using Express Money, the euro crisis countries can speed up monetary circulation in their economies ("liquidity optimization"), thus promoting economic growth, creating new jobs, enhancing tax revenues, and reducing their dependence on foreign countries.

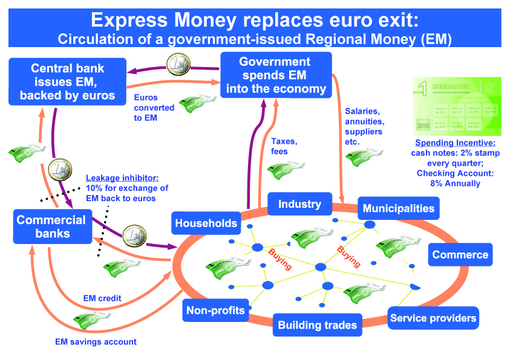

- The parliaments and governments of Greece, Portugal, and/or Ireland can move autonomously to adopt a government-issued regional currency (henceforth: "EM", for Express Money).

- The EM is unique in two ways: 1) Via its spending incentive (a user fee), monetary circulation is accelerated, thereby stimulating the economy. Doubling monetary velocity doubles GNP!

- 2) Via its leakage inhibitor (an exchange fee for conversion into euros), more money stays in the home country, strengthening the regional economy and reducing trade deficits.

- By issuing EM, the government immediately gains a 10% increase in available liquidity, and the spending incentive and leakage inhibitor provide it with further billions of euros. Low-income people bear practically no increased burden.

- EM credits carry a lower interest rate than euro credits, thus facilitating economic investment.

- The EM will quickly become the vehicle for a large percentage of domestic payment transactions.

- The EM will circulate only in the real goods-and-services economy, since it will not be suitable for speculative "financial products".

- Countries will gain the benefits of a regional currency while not being forced out of the euro - an outcome far preferable to a catastrophic euro abandonment.

Express Money will only come about, however, once the idea finds its way to responsible parties in politics, economics, the media, and non-profit organizations, and is subjected to broad public discussion. Translations of this concept into German, English, Greek, Portuguese, etc. are already being prepared (see www.eurorettung.org). Spread the word to everyone whose support will be needed to get Express Money adopted in the crisis countries!